Advertorial

How Smart Pre-Retirees Turn Anxiety Into A Plan (Without Babysitting Their Portfolios)

If you’re in your 50s or 60s, you’ve done a lot of things right: you worked hard, saved diligently, and built a nest egg. Yet the closer retirement gets, the louder the questions become:

“Will my money actually last?”

“What happens if the market pulls back right after I stop working?”

“Why do I feel in the dark about what my advisor is doing with my savings?”

For many, the traditional approach feels like riding a roller coaster you didn’t choose. Performance headlines swing from euphoria to panic. Fees seem to show up like clockwork—results, not so much. And the “plan” often boils down to a hopeful forecast and a pie chart.

The Problems You’ve Been Asked To Tolerate

Let’s name them so we can fix them:

Dependence without transparency. Handing your life savings to someone else and crossing your fingers is not a strategy. As Mark Yegge puts it: “People would hand over their life savings to someone else and just hope it worked out. That never sat right with me.”

Market mood swings. A portfolio tethered only to price appreciation is a portfolio chained to volatility. You get growth… and you get whiplash.

No income plan. Many portfolios were built for accumulation, not distribution. When paychecks stop, the portfolio has to start paying you—reliably.

Time and energy constraints. You don’t want another full-time job watching screens. You want a method that fits into your life, not the other way around.

Analysis paralysis. The internet gives you infinite “opinions,” but no unified system. Without rules, you end up second-guessing yourself—usually at the worst times.

If any of this feels familiar, you’re not broken; the system you were handed is. What you need next isn’t another prediction or stock tip—it’s a process you can understand, control, and repeat.

The Shift: From Prediction To Process

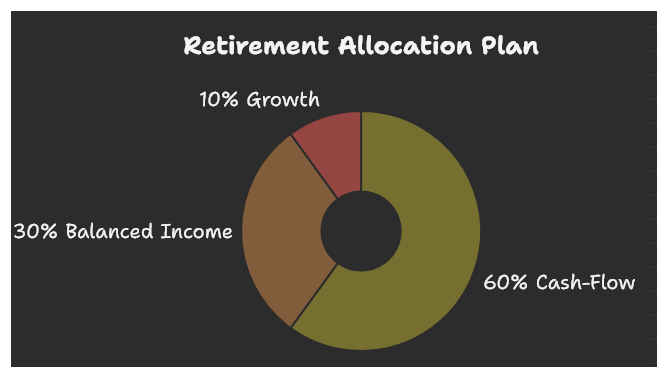

Our community made a simple shift that changes everything: we focus on cash flow first. Instead of hoping the market goes up, we use options to pull cash flow out of positions—with clear, written rules. It’s not day-trading. It’s not gambling. And it’s not handing over control to a black box.

Here’s what the rules aim to do:

Work in up or down markets. We adjust strikes and expirations based on what the market is doing—not what we wish it would do.

Protect capital first. Risk controls, position sizing, and predefined exits come before profit targets.

Fit real lives. The method is designed to be managed in hours per week, not hours per day.

This approach is built for everyday people, not just Wall Street insiders. It’s practical, teachable, and transparent.

“When I show my actual account, people realize this isn’t theory. It’s a framework I use myself.” — Mark Yegge

In our sessions, we walk through real examples—the wins, the losses, and (most important) how we manage risk so losses stay small and recoverable. You won’t get theories; you’ll see decisions.

The traditional playbook—work hard, max the 401(k), hold a diversified mix of funds, and hope—can leave people feeling exposed. It’s not that diversification or advisors are “bad”; it’s that relying on predictions and performance chasing often backfires. Consider two realities:

- Most active stock pickers lag their benchmark. In 2024, 65% of U.S. large-cap active funds underperformed the S&P 500, continuing a long pattern. (S&P Global)

- Behavioral mistakes are costly. DALBAR’s 2025 QAIB report shows the average equity investor gained 16.54% in 2024 vs. the S&P 500’s ~25%—an 848-basis-point gap largely explained by buying high and selling low. (DALBAR, PR Newswire)

It’s no wonder many pre-retirees want a process they control rather than feelings and forecasts. As Mark Yegge, former Wall Street firm owner puts it, “People would hand over their life savings to someone else and just hope it worked out. That never sat right with me.”

Why This Matters For You (Especially Now)

You’ve moved from accumulation to distribution—from “grow it” to “make it pay me.” That requires a different operating system:

Clarity over confusion. A small set of rules beats a feed full of opinions.

Cash flow over guesswork. Monthly income targets provide structure; rules tell you how to pursue them.

Control over hoping. You can’t control markets, but you can control your process, risk, and routine.

If you’ve ever thought, “I don’t need the highest return—I need the right return, with fewer surprises,” you’re our kind of person.

What You’ll Learn Inside Our Cash Flow Training

We don’t ask you to trust us—we teach you to verify with a repeatable checklist. In the training or mentorship, you’ll:

Learn the three big mistakes pre-retirees make with portfolios built for accumulation, not income—and how to correct them.

See how a rules-based options framework can target monthly cash flow without day-trading or staring at charts all day.

Practice a step-by-step decision checklist (strikes, expirations, sizing, exits, adjustments) you can apply in hours per week.

Watch transparent walk-throughs of live examples so you can see how we handle the messy middle—when to hold, adjust, or fold

Who is it for?

Pre-retirees (50s–60s) who want their money to last and prefer a cash-flow plan over stock-picking heroics.

Busy professionals who want portfolio income without turning finance into a second career.

Everyday investors—new or experienced—seeking more control and clarity, whether you self-manage or work with an advisor.

Who it’s not for: anyone looking for a get-rich-quick scheme or a guru to worship. This is education, discipline, and practice—not magic.

We Have The System. You Keep The Control.

Our job is to teach the rules, show you how we apply them, and mentor you as you build confidence. Your job is to bring your goals, your judgment, and your willingness to follow a process.

If you want a calmer, rules-based path to potential portfolio cash flow—and a community that prizes transparency over hype—your next step is simple:

Compliance & Common Sense

This is education, not individualized advice. Investing involves risk, including possible loss of principal. Options are not suitable for everyone; review the risks before trading. Past results don’t guarantee future outcomes. Your decisions are your own—and our goal is to help you make them with clarity, rules, and confidence.

If this resonates, don’t wait for the next news cycle to tell you how to feel about your money. Learn a process you can use in any market—and start building the cash-flow skill set that puts you back in control. Check out a free MasterCourse about targeted cash flow.

The content on this website is provided for educational and informational purposes only. We are not licensed financial advisors, brokers, or dealers. Nothing on this site should be interpreted as personalized investment advice, a recommendation, or an offer to buy or sell any security. Investing and trading involve risk, including the possible loss of principal. Past performance is not indicative of future results. You should carefully consider your financial situation, objectives, level of experience, and risk tolerance before making any investment decision. All examples, strategies, and case studies presented are hypothetical illustrations and should not be relied upon for actual trading. Results will vary, and there is no guarantee of income or profit. Before acting on any information from this site, you should consult with a qualified financial professional who understands your specific circumstances. By using this site, you acknowledge that you are solely responsible for your investment decisions and that neither this website, its owners, nor its contributors are liable for any losses or damages arising from your use of the information provided.

2840 W Bay Drive 182 Belleair Bluffs, FL USA

© 2025 All Rights Reserved.